Table of Content

The interest rate is higher than a HELOC, but it won't fluctuate with the market like the HELOC variable rate does. Our team of independent experts pored over the fine print to find the select personal loans that offer competitive rates and low fees. Get started by reviewing The Ascent's best personal loans for 2022. With a HELOC, you don't borrow a lump sum of cash upfront. Rather, you get access to a line of credit you can draw from during a preset period of time -- often, five to 10 years.

However, it’s important that you explore your options and choose the right type of home equity financing for your needs. Before deciding on any of these home equity choices, be sure to speak with a mortgage professional who can help you understand the pros and cons of each. With this big down payment, you may be able to get into a larger, more expensive home because your mortgage will be smaller. And with a smaller mortgage, your monthly payment will be lower, too.

ways to get a lower monthly cost

You typically have to leave at least 20% equity in your home after doing your cash out refinance, so be sure you have enough equity to accomplish your goals. Qualifying for a home equity loan is similar to qualifying for a mortgage. You’ll have to prove creditworthiness, or that you can repay the loan. Lenders will check your credit score, income, debt-to-income ratio and maximum loan-to-value ratio. Lenders typically prefer your DTI to be less than 43% and an LTV of no more than 80%.

CNET's mission is to give you an unbiased assessment of the products and services that matter most. A dedicated team of editors oversees the automated content production process - from ideation to publication. Ensuring that the information we publish and the recommendations we make are accurate, credible and helpful to you is a defining responsibility for what we do. Editorial integrity is central to every article we publish. Accuracy, independence and authority remain key principles of our editorial guidelines. For further information about automated content on CNET, email Lance Davis, VP of Financial Services Content, at

How home equity loans can affect PMI

If you take out a $20,000 home equity loan but the work ends up costing $25,000, you'll be short. But if you take out a $30,000 HELOC, you'll have the option to only borrow the $25,000 you need. You can deduct home equity loan interest from your federal income taxes if you use the funds to “buy, build, or substantially improve your home,” according to the IRS. Content published under this author byline is generated using automation technology.

Here are questions you should prepare for when getting preapproved for a home equity loan. Cassidy Horton is a writer for Finder, specializing in banking and kids’ debit cards. She’s been featured on Legal Zoom, MSN, and Consolidated Credit and has a Bachelor of Science in Public Relations and a Master of Business Administration from Georgia Southern University. When not writing, you can find her exploring the Pacific Northwest and watching endless reruns of The Office.

How Hard Is It to Get A Home Equity Loan?

Private mortgage insurance allows home buyers to purchase a home with a conventional mortgage loan and less than a 20% down payment. PMI protects the lender from the borrower defaulting on the loan because it's assumed you're at higher risk of defaulting on your mortgage if you cannot make a 20% down payment or greater. Could increase your LTV ratio higher than that threshold, but you won't incur any new PMI charges.

To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. You can use a home equity loan to access the equity in your current home to apply toward a down payment on your next home. This is a popular way to allow you to make a sizable down payment on a new home without needing to sell your current home concurrently.

Home Equity Loans (Second Mortgages)

Having positive equity in your home gives homeowners the flexibility to extract that wealth in a variety of ways. One method for accessing this equity is to pay off part or all of your mortgage by using a home equity loan. In this article, we will examine the pros and cons of this approach.

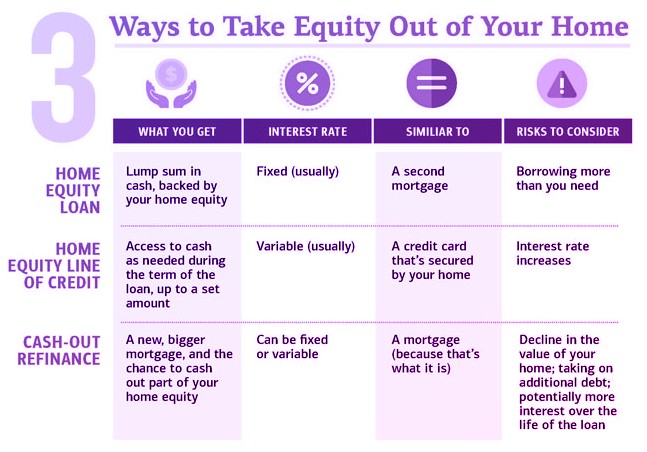

Home equity loan interest rates are almost always fixed, which means they’re stable throughout the life of your loan. They’re generally higher than cash-out refinance rates, but lower than personal loans or credit cards. A cash-out refinance loan is similar to a traditional home equity loan, except you will not have a second mortgage. This is because you are refinancing your existing mortgage into a new home loan for more than you owe, and you take the difference in cash. You should factor in the costs of refinancing when using a cash-out refinance.

In Q2 of 2020 the United States economy collapsed at an annualized rate of 31.7%. In response to the crisis the Federal Reserve quickly expanded their balance sheet by over 3 trillion Dollars. In Q3 the economy boomed, expanding at an annualized rate of 33.1%. The Federal Reserve has remained accomodative, suggesting they are unlikely to lift interest rates through 2023. This has caused mortgage rates to drift down throughout the year.

The calculator returns your estimated monthly payment, including principal and interest. Enter your loan amount, term and interest rate to estimate your monthly payment. To borrow $500,000, for example, you have to have a lot of equity in your home, and your home has to be worth quite a lot of money. On a $100,000 loan, for example, one point would cost you $1,000.

Using equity is a smart way to borrow money because home equity money comes with lower interest rates. If you instead turned to personal loans or credit cards, the interest you’d pay on the money you borrowed would be far higher. If you take out an interest-only or other non-amortizing mortgage, you won’t reduce your principal balance or build equity.

HELOCs & home equity lines also typically have much lower upfront costs & close faster than cash out refinancing. The main reason why homeowners take out home equity loans to pay down their mortgage is that they think doing so will result in lower monthly payments. This can occur when interest rates have declined since they first purchased their home, meaning that the home equity loan would carry a lower interest rate than their existing mortgage. As home equity loans are secured against your home, banks typically offer extremely competitive interest rates for these loan types—usually close to those of first mortgages. Compared with unsecured borrowing sources, such as credit cards, you’ll pay less in financing fees for the same loan amount. One of the biggest perks of homeownership is the ability to build equity over time.

Under the Rule, how long do I have to cancel?

If you’ve worked hard to build equity in your home by making mortgage payments over time, you might be thinking that it's time to put that equity to good use. It’s important to consider that both factors create a variable interest rate for a HELOC. And any variable interest rate can result in higher repayment amounts depending on interest rates and economic factors.

The rest will usually go toward paying interest, property taxes and homeowners insurance. Ultimately, paying off a mortgage using a home equity loan can make sense, but it is not a decision that should be taken lightly. We also provide a simple way to see how much your monthly payments would be for a home equity loan from Discover, with breakdowns for the different term lengths of 10, 15, 20, and 30 years. The home equity loan option amortizes the loan balance over the loan term, resulting in a loan payoff at maturity. The line of credit assumes the user only makes interest payments on the full line of credit.

No comments:

Post a Comment